When you’re ready to move into a new home, every minute counts.

After all, you want to enjoy as much time as possible in your new space — putting your own personal touches on each room, making connections in your new neighborhood, and building memories to last a lifetime.

But before you can get there, you want the home loan process to go as smoothly as it can. And that’s where preparation comes into play!

On average, it takes a mortgage loan 30 to 60 days to close — although it can be significantly longer or shorter than this timeframe. (Fun fact: For many years, Waterstone Mortgage has consistently closed loans several days* faster, on average, than other lenders. In fact, we’re known for closing loans on time, if not ahead of schedule.)

While 30-60 days may not seem that long, it can feel like an eternity when you’re waiting to move into your new home. Thankfully, there are several dos and don’ts you can keep in mind to help ensure you close on time.

But before we even get to those, it’s important to note that receiving a pre-approval from a reputable mortgage lender before you start house-hunting will put you on track for closing on time.

Because a pre-approval involves a preliminary look at your financial picture and determines the home loan amount that you are likely to qualify for, you’ll already be one step ahead when it’s time to initiate the mortgage approval process. Without a pre-approval in hand, you might experience some delays and bumps along the way.

If you want a rock-solid pre-approval that will speed up your closing process even more, go with a fully credit underwritten pre-approval, such as our Platinum Credit Approval (PCA).** This allows you to submit most of your paperwork before you make an offer on a home, so there’s very little left to be completed after your accepted offer. Essentially, if your financial situation stays the same, the property meets the conditions of your loan of choice, and all contingencies are met, your mortgage should close quickly and seamlessly.

Now, let’s get to the good stuff. Here is what you want to do (and what you should avoid) during your mortgage loan process…

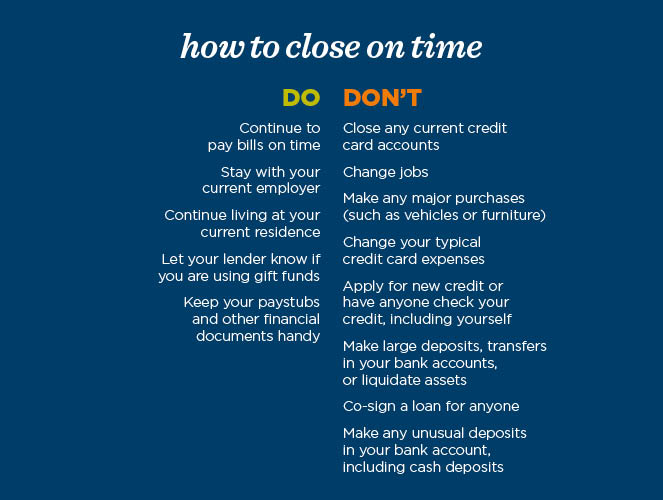

Do:

- Continue to pay bills on time

- Stay with your current employer

- Continue living at your current residence

- Let your lender know if you are using gift funds

- Keep your paystubs and other financial documents handy

Don’t:

- Close any current credit card accounts

- Change jobs

- Make any major purchases (such as vehicles or furniture)

- Change your typical credit card expenses

- Apply for new credit or have anyone check your credit, including yourself

- Make large deposits, transfers in your bank accounts, or liquidate assets

- Co-sign a loan for anyone

- Make any unusual deposits in your bank account, including cash deposits

In other words, it’s important to keep your financial habits and source of income steady. If you normally charge your weekly groceries, continue to do so. If you typically deposit a check once monthly, keep it that way. You get the idea! Any large purchases — even furniture — should be off limits.

It’s also important to be open with your loan originator about your financial situation. The more transparent you are, the more likely you’ll be able to get to the closing table on time.

For instance, many homebuyers don’t think they need to disclose if they are using money from someone else (maybe a parent or grandparent). However, this is extremely important for your loan originator to know, as it is outside of your normal income and assets. Letting your loan originator know in advance can save you time down the road.

Closing on time is a major priority for many homebuyers, and it’s a major priority for us here at Waterstone Mortgage. If you have a specific question about your financial situation, find a loan originator in your area to go over the details.

The suggestions listed above are intended for informational and educational purposes only and do not constitute legal advice or debt counseling.

*According to ICE Mortgage Technology Origination Insight Reports.

**A Platinum Credit Approval is a pre-approval program offered by Waterstone Mortgage. In accordance with federal regulations, consumers are not required to provide verifying documents until they have submitted an application, received a Loan Estimate Disclosure, and stated their intent to proceed with the loan transaction. A pre-approval is not an offer to enter into an agreement, which must be made separately and in writing, and should not be construed as a commitment to lend. Waterstone Mortgage is not obligated to close and fund this loan unless all terms and conditions of the pre-approval have been met. Once a property is selected, Waterstone Mortgage must order and receive a satisfactory flood zone determination, property appraisal, and a satisfactory private mortgage insurance certification, if required. Waterstone Mortgage reserves the right to cancel this pre-approval in the event of any material misrepresentation in the customer’s application, in the event of an adverse change in the customer’s credit history, employment, income, assets, debt, or other factors affecting their financial status, or if the above requirements are not satisfied. **Customer must receive a fully approved, not conditional, underwritten Waterstone Mortgage Platinum Credit Approval (PCA) issued prior to the date of the purchase contract to qualify for the Platinum Credit Approval Closing Guarantee (PCACG) and must complete all steps required by Waterstone Mortgage as part of the loan process, including, but not limited to, all documentation, information requested, and authorization for Waterstone Mortgage to obtain a full tri-merge credit report. The PCACG shall not apply unless all terms and conditions of the PCA have been met. The PCA is a preapproval program offered by Waterstone Mortgage. In accordance with federal regulations, consumers are not required to provide verifying documents until they have submitted a loan application, received a Loan Estimate Disclosure, and stated their intent to proceed with the loan transaction. A pre-approval is not an offer to enter into an agreement, which must be made separately and in writing, and should not be construed as a commitment to lend. The PCACG becomes void in the event of any material misrepresentation in the customer’s application, or an adverse change in the customer’s credit history, employment, income, assets, debt, or other factors affecting their financial status. Further, the PCACG is contingent upon the honest and accurate representation of all parties involved. Any act of fraud, misrepresentation, or deceit committed by either the buyer or the seller during the course of the transaction shall render the PCACG null and void. Provided the loan does not close due to a Waterstone Mortgage underwriting error and the requirements outlined herein are satisfied, Waterstone Mortgage will pay the seller of the subject property $5,000 within ten (10) business days. Rates, program terms, and conditions are subject to change without notice. The PCACG is for conforming Conventional, FHA, VA, and USDA loan programs only. If you elect to change loan programs after the PCA approval and your eligibility for the program no longer qualifies, the PCA approval will render this offer void.