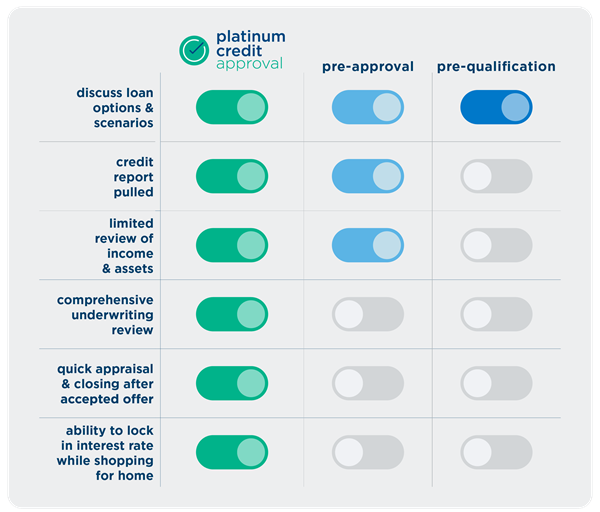

These terms are often used interchangeably in the mortgage world, but they are three unique processes. Find out which is right for your situation.

Platinum Credit Approval

what is a Platinum Credit Approval?

The Waterstone Mortgage Platinum Credit Approval (PCA) is the strongest mortgage loan pre-approval a homebuyer can receive.

The Platinum Credit Approval process gives you, the homebuyer, the opportunity to submit a full-document loan application before you begin searching for a home. Once the application is submitted, our underwriting team will confirm your eligibility and issue a fully underwritten loan approval — with the exception of the specific property, which you will confirm at a later time. Essentially, you've completed most of the work upfront, so the rest of your loan approval process will be streamlined and simplified!

With a Platinum Credit Approval in hand, you will have a competitive advantage and the confidence to make a compelling offer on your dream home. In addition, homebuyers with a Platinum Credit Approval experience several unique benefits that make them stand out from other buyers in the market.

When you're house shopping with a Platinum Credit Approval, you'll have a variety of advantages over other buyers who are not pre-approved for a mortgage.

Realtors: Your buyers can shop with confidence by securing a full credit approval for their mortgage before beginning the home search process.

As a homebuyer, getting a Platinum Credit Approval could save you time and money throughout the loan process.

Platinum Credit Approval is a smart option for buyers. Get a head start on the homebuying process by discovering more about this program!

Pre-Qualification

Pre-qualification is an informal process where a homebuyer provides their potential lender with some basic information, such as their current income and debt levels. Then, the lender calculates an estimated mortgage loan amount that the homebuyer may qualify for. The key word here is: informal. While a pre-qualification can be helpful at the beginning of your mortgage journey, it’s a very high-level, general estimate. To get a more accurate picture of what you can afford, a pre-approval or a PCA are better options.

Pre-Approval

A pre-approval has a more formalized process than a pre-qualification. If you’re hoping to buy a home and are ready to get pre-approved for a mortgage, we’ll ask you to provide supporting documents such as recent paycheck stubs and bank statements. We’ll also pull and review your credit report. Then, an Automated Underwriting System (AUS), along with our underwriting team, will determine your eligibility. Your Waterstone Mortgage loan originator will review the information in more detail to approve or deny a loan amount.

Platinum Credit Approval

A Platinum Credit Approval (PCA) is the most formal version of the pre-approval process, and it will give you the most accurate picture of the loan amount you may qualify for. To receive a Platinum Credit Approval, you will complete the same steps needed for a traditional pre-approval. In addition, our underwriting team will complete an in-depth analysis of your credit, financial, and employment information. After you make an offer on a property and it’s accepted, you’re well on your way! An appraisal of the property will be completed and — as long as all conditions for the home and the loan are met — a quick closing follows.

Experienced Realtors know that a buyer who is ready to make an all-cash offer has a distinct advantage. Homebuyers with cash can close swiftly without last-minute mortgage loan conditions, which is very attractive to home sellers. As a result, real estate agents know that their clients who need financing may find it difficult to compete against all-cash buyers for the same desired property.

Fortunately, a real estate professional whose client has a PCA from Waterstone Mortgage can rest assured that their customer can reasonably compete on a level playing field and realistically win in a bidding war – even against all-cash offers.

Which mortgage loan programs are eligible for Platinum Credit Approval?

-

Bond and down payment assistance (DPA) programs — ask for details

Which mortgage loan programs are not eligible for Platinum Credit Approval?

-

Brokered loans

-

Construction loans

-

Certain specialty/niche loans

-

Jumbo loans

-

Reverse Mortgages

The Platinum Credit Approval process is very similar to the pre-approval process, with a few additional steps. If you're interested in obtaining a PCA before you begin home shopping, you can start by completing a loan application (1003) with all the required supporting documents.

With your authorization, we will pull a credit report and run the Automated Underwriting System (AUS). Your loan originator and their team will then prepare your loan application package to be submitted to our underwriting team for full review and loan eligibility determination.

Assuming all is in order and your fully documented application is approved by our underwriting team, you will receive a Platinum Credit Approval certificate. At this point, you are now free to shop for your dream home with clarity and confidence!

Finally, all that’s needed is proof of the property’s value (e.g., appraisal) and adequate insurance (e.g., insurance binder). Once these are received, you’ll be well on your way to a speedy closing process.

If you have a Waterstone Mortgage loan originator, you can simply ask about getting a Platinum Credit Approval (PCA) before you start home shopping. If not, you can find a WMC loan originator who is local to you. Either way, you can begin the PCA process by completing and submitting your loan application. From there, your loan originator will walk you through the steps of receiving a PCA.

After you complete and submit your mortgage application, your loan originator will walk you through all the specific documents needed to obtain a PCA. A few of these may include:

- Copy of your driver’s license

- Last 2 years of W2 statements from your employer

- Last 30 days of pay stubs

- Last 2 months of checking account statements — all pages

- Last quarter (3 months) of stocks/bonds/mutual funds/401K — all pages

- Name and phone number of your landlord to verify rental payments, if applicable

- Divorce decree or court order defining alimony or child support payments, if applicable

- College transcripts (if you graduated within the last 2 years)

If you currently own a property, you will also be asked to provide:

- Mortgage statement

- Tax bill

- Homeowners insurance policy

If you are self-employed, you must also provide:

- Last 12-24 months of profit and loss statements

A down payment is not needed to qualify for a PCA. However, the home loan you decide on may require a down payment — it depends on which type you choose. Your WMC loan originator can walk you through all your options; we have many no-down-payment and low-down-payment loan programs.

Lock & Shop protects homebuyers in markets where interest rates are rising or fluctuating. After you receive your PCA, you’ll lock in your interest rate. You can choose either a 60-day rate lock or a 90-day rate lock.

If you opt for 60 days, you will have 30 days to shop for a home. If you choose the 90-day option, you’ll have 60 days to find a home. The extra 30 days at the end of the rate lock period helps you avoid any extension fees and gives our team time to process things on the back end.

A home appraisal is a thorough inspection of the home you’re buying (conducted by a licensed professional) to determine its value. Your Waterstone Mortgage loan originator will order the appraisal after your offer has been accepted by the property’s seller. The appraiser looks primarily at the condition of the home — and the value of comparable properties in that area — to determine the home’s value.

Homeowners insurance is not required by law; however, it is required by most lenders. Homeowners insurance covers damage to the home, both internal and external. It also covers liability if someone is injured while on your property.

A Platinum Credit Approval is a pre-approval program offered by Waterstone Mortgage. In accordance with federal regulations, consumers are not required to provide verifying documents until they have submitted an application, received a Loan Estimate Disclosure, and stated their intent to proceed with the loan transaction. A pre-approval is not an offer to enter into an agreement, which must be made separately and in writing, and should not be construed as a commitment to lend. Waterstone Mortgage is not obligated to close and fund a loan unless all terms and conditions of the pre-approval have been met. Once a property is selected, Waterstone Mortgage must order and receive a satisfactory flood zone determination, property appraisal, and a satisfactory private mortgage insurance certification, if required. Waterstone Mortgage reserves the right to cancel a pre-approval in the event of any material misrepresentation in the customer's application, in the event of an adverse change in the customer's credit history, employment, income, assets, debt, or other factors affecting their financial status, or if the above requirements are not satisfied.