Getting an appraisal is an important part of the homebuying process. Whether you’re buying, selling, or refinancing your mortgage, it’s important to understand how appraisals work.

What is an Appraisal?

A home appraisal is a thorough inspection of the home you’re buying or selling (conducted by a licensed professional) to determine its value. This is important to determine whether the list price of a home is fair given its true worth. For example, you can’t just list a home for $400,000 if it’s only worth $200,000.

Appraisals are almost always required for purchase transactions (if you’re taking out a mortgage loan). They are often required in refinances too, to ensure the homeowner isn’t taking out a mortgage for an amount that’s more than the home is worth.

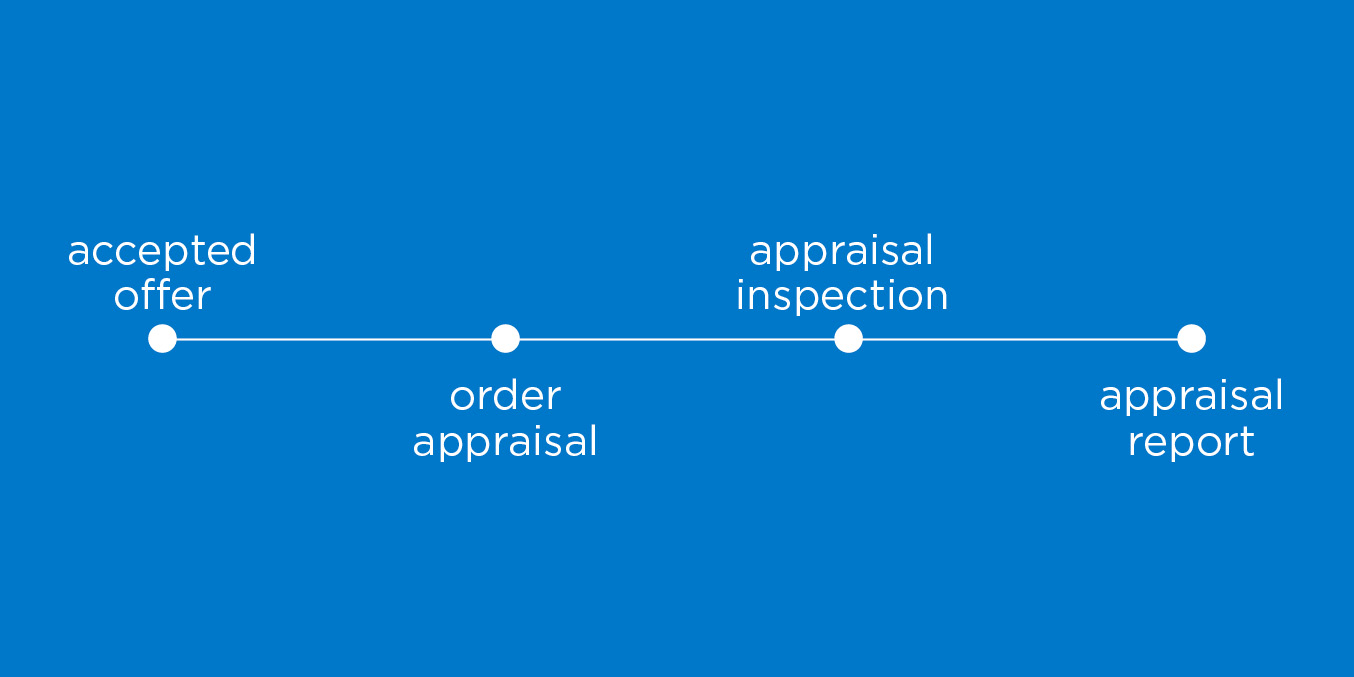

The Appraisal Process

Accepted Offer

After your offer is accepted on your new home, the home will get appraised.

Order Appraisal

Your mortgage lender (typically, your loan originator) will order an appraisal. Once an appraisal is ordered, the appraiser will reach out to buyer to schedule a time for the property appraisal.

Appraisal Inspection

The appraiser will inspect the property and assess the neighborhood and comparable homes.

Appraisal Report

Your loan originator will receive the final appraisal report, which will determine what the home is worth. After the appraisal is ordered, you can expect this in as little as a few days or as long as a few weeks, depending on the availability of your appraiser.

If the appraisal comes back with a value lower than the sale price, you might be able to negotiate with the seller to reduce the price. Or, if you have a contingency outlined in your contract, you may walk away from the deal if the appraisal comes back significantly lower than your accepted offer. Either way, your loan originator can walk you through the possible outcomes and how to navigate them.

What Do Appraisers Look For?

Home appraisers are licensed professionals that undergo extensive training to do their job. Each appraisal may go differently, but there are several key things the appraiser looks for when inspecting the condition of the property, such as:

- External factors: The neighborhood, lot size, zoning classification, car storage, etc.

- Internal factors: Square footage, number of bedrooms/bathrooms, basement space, foundation type, etc.

- General condition of the home

- Home improvements, upgrades, and renovations

How to Prepare for a Home Appraisal

If you’re selling your home, the appraisal process can be intimidating. However, there are a few things you can do to make sure everything goes as smoothly as possible.

- Clean inside and outside. Cleaning your home might be a no-brainer, but don’t forget the exterior! Making sure everything is tidy before the appraiser arrives is crucial.

- Take care of minor fixes. Remember those things you’ve been putting off because they weren’t a big deal? They just became a big deal. Things as minor as paint touch-ups, squeaky doors, or leaky faucets can make a difference in the outcome of your appraisal.

- Document upgrades you’ve made. If you’ve renovated your home or made any upgrades, have documentation on hand for your appraiser to review. This could include receipts, invoices, or contracts — whatever you have to prove you enhanced the value of your property.

- Spruce up your space. Not only should your home be squeaky clean, it should also look better than it ever has. Small tweaks won’t make a world of difference in the appraisal, but making sure everything is presentable overall can have a positive impact.

Drive-By Appraisals

“Drive-by” appraisals, or exterior-only appraisals, became increasingly popular in 2020 due to the COVID-19 pandemic. In some areas, they are still popular.

During a drive-by appraisal, the appraiser will examine the exterior of the home, the property as a whole, and the surrounding area. They’ll also review data on similar home sales in your area for comparison. The appraiser may also request photos of the interior.

These types of appraisals are 100% legitimate and may be a preferred method in some situations. However, the availability of drive-by appraisals varies by lender and loan type.

Do you have questions about the appraisal process? Contact a local home loan expert in your area to learn more.