When it comes to financing a home, choosing the right type of mortgage is critical. For veterans, active-duty service members, and some surviving spouses, VA loans can offer a unique set of advantages. But how do VA loans differ from conventional mortgages? We’ll explore a few key areas here:

Eligibility and Qualification

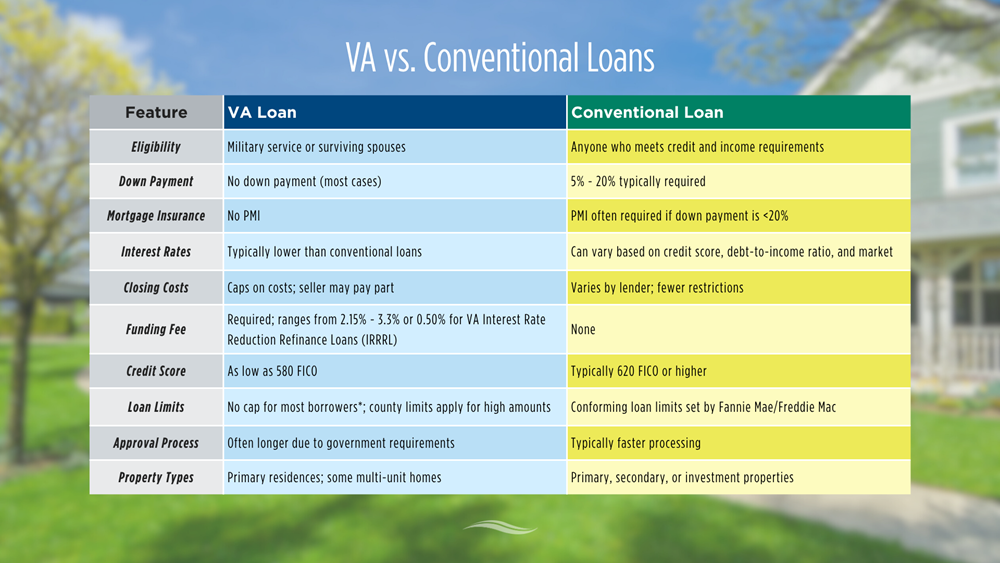

One of the most significant differences between VA and conventional loans is who can apply. VA loans are specifically reserved for those who have served in the military or are currently serving, as well as some surviving spouses. Eligibility depends on the length and nature of service, with general requirements including 90 days of service during wartime or 181 days during peacetime.

Conventional loans, on the other hand, are available to anyone who meets the lender’s standard qualifications. These usually include meeting specific credit, income, and debt-to-income requirements. Unlike VA loans, there is no special consideration given to military service, which can make it harder for those with lower credit scores or limited savings to qualify.

Down Payment Expectations

One of the most attractive features of a VA loan is the ability to purchase a home with no down payment. For many borrowers, especially first-time buyers, saving for a down payment is one of the biggest hurdles to homeownership. With a VA loan, qualified applicants can often finance 100% of the home’s purchase price.

Conventional loans typically require a down payment, with most lenders asking for anywhere between 3% and 20%. The more you put down, the better your loan terms may be — but this upfront cost can be a barrier for some buyers.

Mortgage Insurance Considerations

If you are a veteran and paying mortgage insurance is a concern, this is another area where VA loans shine. With a VA loan, there’s no need for private mortgage insurance (PMI), even if you're not making a down payment. This alone can save borrowers hundreds of dollars each month.

On the other hand, most conventional loans require PMI if the buyer puts less than 20% down. While PMI can eventually be removed once enough equity is built, it still adds an extra cost early in the life of the loan.

Interest Rates and Affordability

In many cases, VA loans come with lower interest rates than conventional loans. Because they’re backed by the U.S. Department of Veterans Affairs, lenders face less risk and can pass those savings on to borrowers. This can lead to significant long-term savings over the life of the loan.

Conventional loan interest rates vary widely depending on a borrower's credit score, down payment, and market conditions. Generally, homebuyers with excellent credit can secure competitive rates, but those with less-than-perfect credit may face higher costs compared to a VA loan.

Closing Costs and Associated Fees

While closing costs are a reality with any home loan, VA loans include protections that limit what lenders can charge. There are caps on fees such as origination charges and — in many cases — sellers are allowed to cover some of the buyer’s closing costs. This ultimately reduces the buyer’s financial contribution at closing.

With conventional loans, closing costs tend to vary depending on the lender and the specifics of the deal. There are typically fewer restrictions on what can be charged, and seller contributions are more flexible but not guaranteed.

The VA Funding Fee

Although VA loans don’t require PMI, they do come with a one-time funding fee. This fee helps sustain the VA loan program and can range from 2.15% to 3.3% of the loan amount, depending on the borrower’s military status and down payment amount. (The fee is 0.50% for VA Interest Rate Reduction Refinance Loans, also called IRRRL). The good news is this fee can often be rolled into the loan amount, avoiding the need to pay it up front.

Conventional loans do not charge a funding fee. However, PMI may apply, which can become a long-term monthly expense until sufficient equity is built in the home.

Credit Score Requirements

VA loans offer more lenient credit score guidelines (as low as 580 FICO) compared to conventional financing. Because VA loans are more forgiving, veterans with less-than-ideal credit may still have a path to homeownership.

Conventional loans tend to require higher credit scores to secure favorable terms. Most lenders prefer at least a 620 score, but homebuyers with a 740+ score typically receive the best rates. This can potentially make the conventional path more difficult for borrowers with a rocky credit history.

Loan Limits and Borrowing Power

Recent updates to the VA loan program have increased the loan limits for most borrowers with full entitlement, meaning veterans have more flexibility to buy homes at a higher price point without needing a down payment. That said, there are still regional limits in certain high-cost areas, especially for borrowers who’ve used part of their entitlement before.

On the other hand, conventional loans are subject to conforming loan limits set by Fannie Mae and Freddie Mac, which vary by county. Any amount above the conforming loan limit is considered a jumbo loan, which typically comes with stricter requirements.

Loan Process and Timeline

The VA loan process can sometimes take slightly longer than conventional loans, mainly due to the documentation involved. However, many lenders have streamlined their VA processes to reduce delays for applicants who already have their paperwork in order.

Conventional loans are often faster to close, as they don’t involve any government agency oversight. Lenders can typically move forward quickly once they've verified credit, income, and property value.

Property Type Flexibility

Another key distinction between VA and conventional loans lies in the types of properties you can buy. VA loans are designed for primary residences only. That means vacation homes and investment properties aren’t eligible. However, VA loans can be used to purchase a variety of primary residence types, including single-family homes, condos, manufactured homes, and even multi-unit properties — as long as the borrower lives in one of the units.

Conventional loans offer more flexibility in this area. Buyers can use them to purchase not only primary residences but also second homes and rental properties. This often makes them a better choice for buyers with diverse real estate goals.

Which Loan Is Right for You?

Ultimately, the choice between a VA loan and a conventional mortgage depends on your individual situation. VA loans are often the better option for eligible veterans and active-duty service members who want to buy with no money down, avoid PMI, and secure competitive interest rates.

Conventional loans, meanwhile, may be more suitable for buyers who don’t qualify for VA benefits, or for those interested in second homes, vacation properties, or real estate investments.

Understanding the key differences can help you make an informed decision that aligns with your goals and financial picture. If you qualify for a VA loan, the benefits are hard to beat — but it’s always worth comparing your options and working with a knowledgeable lender to find the best fit.

Waterstone Mortgage: Partnering with Veterans and Military Service Members

At Waterstone Mortgage, we are proud to support veterans and military service members by helping them utilize their VA benefits to purchase or refinance a home. Our team of experienced loan officers is dedicated to guiding you through the process, ensuring you understand your options and eligibility. Whether you're a first-time VA homebuyer or looking to refinance your current mortgage using your VA benefit, we’re here to provide personalized support every step of the way. Get started by connecting with a loan officer, so you can secure the home you deserve with the benefits you’ve earned.

A VA loan is a government-insured loan subject to certain qualifications and restrictions. A VA funding fee is typically required, which can be financed into the loan amount. If you are a servicemember on active duty, prior to seeking a refinance of your existing loan, consult your legal advisor regarding the loss of any benefits you are entitled to under the Servicemembers Civil Relief Act or applicable state law.

*Full entitlement required for specific loan amounts, ask your loan originator for details. A VA loan is a government-insured loan subject to certain qualifications and restrictions.

All loan requests are subject to credit approval as well as specific loan program requirements and guidelines.