For some seniors (ages 62+), using a reverse mortgage to buy a home can be an ideal way to preserve their financial assets.

For many homeowners, it can be beneficial to have more equity in their home — even if that means less cash in their savings. For seniors, however, the opposite can sometimes be true.

If you know a senior (age 62+) who would like to purchase a home but would also like to retain as much of their cash savings as possible (for future medical expenses, travel, unexpected bills, etc.), they might benefit from a reverse mortgage.

How does someone use a reverse mortgage to purchase a home?

The process is similar to a conventional loan purchase, except the homebuyer needs to complete homeowner education before submitting a loan application. Like conventional mortgages, it’s important to talk to an experienced loan originator early in the process, so you can receive a credit pre-approval before entering into a purchase agreement.

Is it better for seniors to pay all cash for a home or preserve their savings?

Like many mortgage questions, the answer to this will vary from situation to situation. Most seniors don’t want to make a monthly principal and interest payment, so they decide to pay cash for a home — if they have the full cash amount available.

However, depending on how much savings they have after the transaction, paying cash may not be the best choice. Since a reverse mortgage does not require a monthly principal or interest payment for as long as the senior lives in the home, using a reverse mortgage will help them preserve their savings — so they have cash available for unexpected expenses.

In retirement, cash (savings) is often viewed as more important, because seniors usually have less time and financial ability to replace depleted savings that were used for unexpected/emergency expenses.

Again, every situation is unique. This is why it’s important for senior homebuyers to consult with an experienced loan professional to determine which mortgage type is the best fit for their needs.

What about seniors who don’t have the full cash amount to pay for a home?

Some retirees will carry a mortgage into their retirement years, so they will pay interest whether they have a conventional mortgage or a reverse mortgage.

If they make the monthly mortgage payment from their cash account, their cash balance goes down by the total amount of the payment and their equity goes up slightly by the principal amount of the payment. If they have a reverse mortgage and do not make a monthly payment, their cash balance will remain the same and their equity will go down by the amount of the monthly interest.

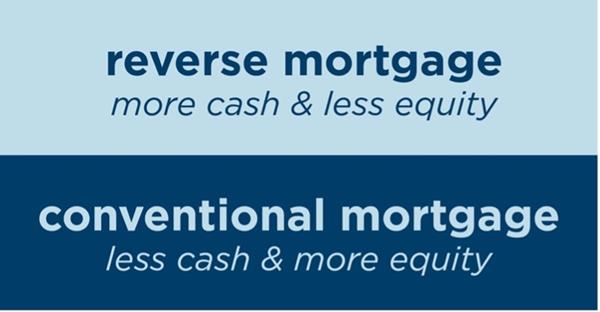

In either case, their net worth is nearly the same. They are simply choosing which is more beneficial for their situation:

At Waterstone Mortgage, we help seniors explore whether a reverse mortgage is ideal for their current circumstances and long-term goals. Because reverse mortgages are unique, we take the time to answer questions, address concerns, and help our potential clients strategize for the future.

Interested in learning more? Get in touch with a trusted Reverse Mortgage Specialist at Waterstone Mortgage. It’s our goal to help senior citizens create a more financially stable and secure retirement.

Property and borrower eligibility requirements apply. Loan becomes due and payable when the last remaining borrower (or eligible spouse) sells the property, permanently leaves the home or passes away. Taxes, insurance, and repairs are the responsibility of the borrower and must be maintained to avoid early repayment of the entire loan amount. Consult a tax advisor for questions about tax and government benefit implications.