So often, we hear about how important it is to build good credit. After all, having a good credit score opens the door to more financial possibilities, such as purchasing a home.

Most people have a general idea of how credit scores work. According to the Fair Isaac Corporation (FICO), credit scores range from 300 to 850, with 300 being very poor and 850 being excellent.

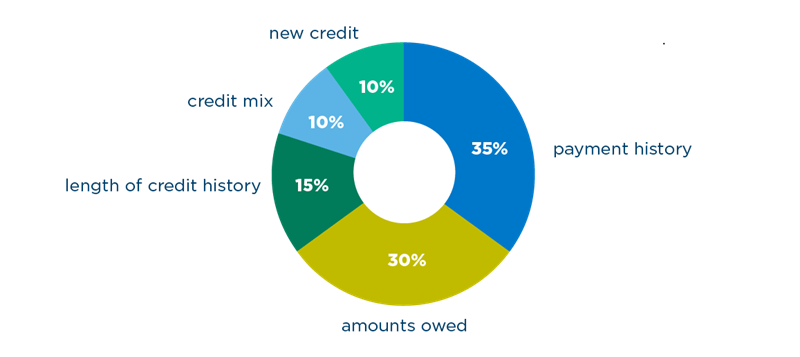

But many of us (maybe even most of us) don’t know exactly how a credit score is determined. Paying your bills on time is only a small part of the overall big picture!

So, to bring you up to speed, let’s take a look at the components of a credit score from information we gathered from FICO…

Payment History (35%)

It’s pretty obvious that paying your bills and debts on time will help improve your credit score. But, if you miss a few payments over the course of several years, don’t lose hope.

A few late payments over the course of an otherwise healthy credit history shouldn’t drop your score drastically. And, vice versa, just because you’ve paid EVERY bill on time doesn’t mean you’ll automatically have a high credit score. Remember: payment history is just one piece of the puzzle!

Amount Owed (30%)

Owing money is not a bad thing. We repeat: owing money is not a bad thing! However, it’s important to prevent yourself from being overextended.

For instance, if you have a high credit card limit and a low balance that you pay off each month, this will most likely make a positive impact on your credit score.

If you have a moderate credit limit and you’re always reaching (or surpassing) that limit, that’s probably going to negatively impact your credit score.

Length of Credit History (15%)

Basically, it’s better to have credit lines that are open for longer periods of time. However, this isn’t necessarily required. FICO looks at how long your credit accounts have been established and considers: the age of your oldest account, the age of your newest account, and the average age of all your accounts.

Credit Mix (10%)

A variety of credit lines can be beneficial to your credit score. So, for instance, a mix of credit cards, store credit cards, mortgage loans, and car loans will help boost your score — if those accounts are paid on time.

New Credit (10%)

Applying for new credit (opening new accounts) is generally a good thing, but just make sure you’re doing this in moderation. If you open four new credit cards in a six-month period, for example, this could potentially lower your credit score. The key is to make changes gradually, so you don’t overextend yourself with too many accounts.

Everyone’s situation is unique, but these are some general guidelines that you can take into consideration as you improve or continue to maintain your credit score.

Remember, talking to a professional financial advisor is your best bet for gaining personalized, expert guidance on building your credit. Even if your credit is poor, there may be a mortgage loan with flexible credit requirements that fits your situation.

We hope this gives you some insight, as you prepare to purchase a home… whether it’s soon or several years down the road. Find a local mortgage expert in your area to learn more.