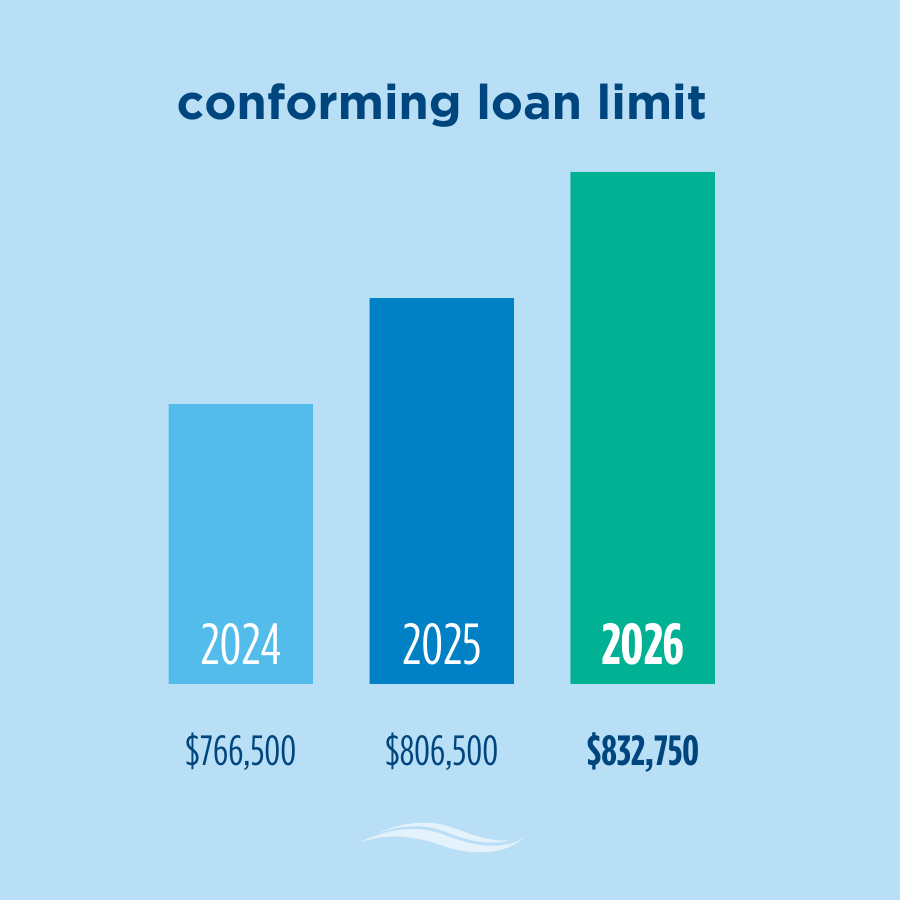

The FHFA’s updated 2026 conforming loan limit could expand buying power for many homebuyers.

What is the 2026 Conforming Loan Limit?

The Federal Housing Finance Agency (FHFA) recently increased the conventional conforming loan limit for one-unit single-family homes from $806,500 in 2025 to $832,750 in 2026.

The loan limit has increased by more than $25,000 — a response to persistent inflation and ongoing affordability challenges in the housing market.

What Does the 2026 Loan Limit Increase Mean for Homebuyers?

Homebuyers can now purchase a home with a conventional loan amount up to $832,750, whereas loans of this amount would previously require a jumbo loan. Jumbo loans serve as an excellent option for those with a higher budget, but they often require a larger down payment and have more stringent credit requirements.

Conventional Loan Benefits

Conventional loans, or loans that can be purchased by Fannie Mae and Freddie Mac, provide a more accessible, flexible option for homebuyers. Some benefits include:

- Down payment requirement as low as 3%

- Credit score requirement as low as 620

- Fixed- and adjustable-rate mortgage options

- No mortgage insurance required with 20%+ down payment

How Is the Conforming Loan Limit Determined?

The conforming loan limit is determined by the Federal Housing Finance Agency (FHFA) and fluctuates annually to reflect the average home price in any given area. Some high-cost areas of the United States have a larger conforming loan limit amount.

Why Is There a Conventional Loan Limit?

The conforming loan limit is the largest mortgage amount allowed for Fannie Mae and Freddie Mac — the two major mortgage investors — to purchase.

After your mortgage loan is funded, your lender will often sell the mortgage to a government-sponsored enterprise (GSE) like Fannie Mae or Freddie Mac. These are private companies that receive support from the federal government. Selling the loan to them allows lenders to free up their funds so they can fund more mortgage loans.

The notion of conventional loan limit was established by the Housing and Economic Recovery Act of 2008 in an effort to set boundaries on the types of loans GSEs could purchase (and ultimately prevent another housing market crash).

Is 2026 the year you achieve your homeownership goals? Find a home loan expert in your area today to get started with a pre-approval.