The prime rate might be an unfamiliar term; but if you own a home or would like to become a homeowner, it can be beneficial to learn where the prime rate comes from and how it could potentially impact your mortgage.

In the world of mortgages, interest rates are often a hot topic. Understanding where mortgage interest rates come from (how they’re determined) is no easy feat, but it helps to have a basic understanding — especially if you currently own a home or are interested in buying one in the future.

One term you may have heard tossed around is the “prime rate.” While the prime rate doesn’t directly determine mortgage interest rates — since it’s used as an index for certain variable rate mortgage and home equity loan programs — it does have a significant impact on how the interest rates fluctuate on those programs.

What Is the Prime Rate and How Is It Calculated?

The Wall Street Journal prime rate is determined by surveying the 30 largest commercial banks in the nation. Each of those banks has its own prime rate — a specific interest rate that they use for loans to their most “creditworthy” customers; this impacts loans such as car loans, mortgages, home equity lines of credit, etc.

How Do These Big Banks Determine What Their Prime Rate Will Be?

It all starts with the Federal Reserve, which is the central bank of the United States. Multiple times throughout the year, the Federal Reserve determines the federal (fed) funds rate (which is based on the rate banks charge for the money they lend to one another). Typically, the banks will then take the fed funds rate and add about 3% to determine their own prime rates. So, for instance, if the current fed funds rate is 5.5%, the overall, nationwide prime rate will hover around 8.5%.

Why Does the Prime Rate Matter to a Regular Person Like Me?

The prime rate ultimately impacts the finances of many people. If you have credit cards, a mortgage, car loans, a small business loan, or a personal loan, the prime rate will influence the interest rate you pay for any of these. A higher prime rate typically means you will pay higher interest on your loans, and vice versa.

How Does the Prime Rate Impact My Mortgage?

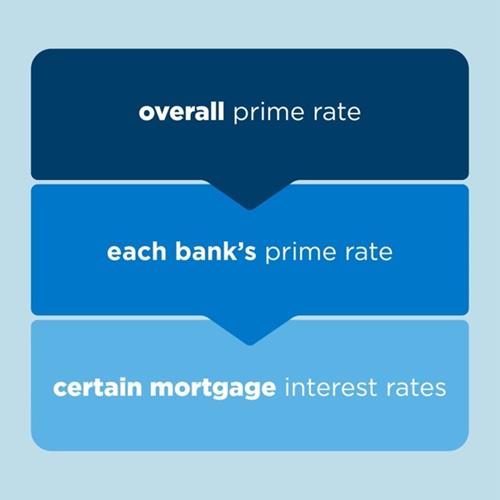

Because the prime rate influences the baseline interest rate that most banks use, this will impact where your mortgage interest rate falls. Think of it as a cascading effect — the overall prime rate impacts each bank’s individual prime rate, which impacts certain mortgage interest rates. As the prime rate increases or decreases, this will particularly impact homeowners with adjustable-rate mortgages. As the prime rate decreases, it may be an ideal time for homeowners to refinance their mortgages to a lower interest rate.

How Often Does the Prime Rate Change?

The prime rate will fluctuate whenever the Federal Reserve changes the fed funds rate. The Federal Reserve meets and issues a change (or no change) to the fed funds rate eight times every year (these meetings are usually spaced out every six to seven weeks, although they are sometimes more frequent).

After the fed funds rate is updated, commercial banks follow suit and update their prime rates to reflect the change. This usually happens within a day or two of the Federal Reserve’s action, but the loan programs that use the prime rate as the index to adjust rates may have a lookback timing lag built in. Because of this slight delay, consumers with those loans may not see a change reflected in their rates until several weeks (up to a month) later.

Of course, this is a high-level starting point when it comes to understanding the prime rate. If you have any questions on how this information could impact your mortgage (or future mortgage), it’s best to consult with an experienced mortgage professional.