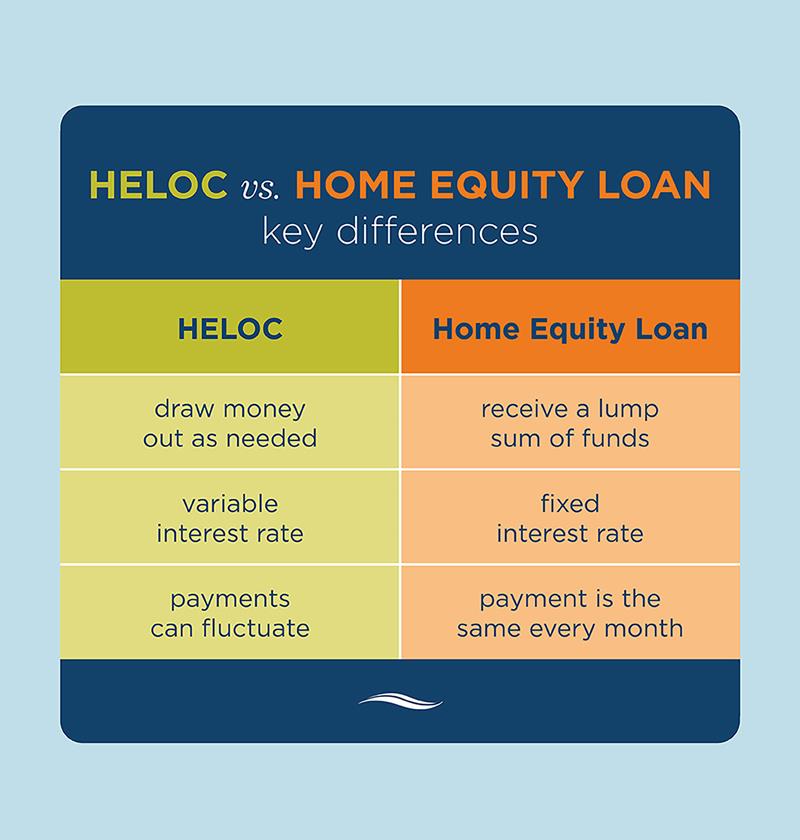

Home equity loans and home equity lines of credit are both ways of tapping into your home’s equity, but there are a few key differences.

Homeownership opens doors (literally) to several financial opportunities, amongst which are home equity loans and home equity lines of credit (HELOCs). These financial products provide homeowners with tools to tap into the value they have built in their homes over time.

However, home equity loans and HELOCs are not entirely identical twins. If you're seeking to leverage your home's value, it's essential to understand the fundamental differences between home equity loans and home equity lines of credit.

Defining Home Equity Loan

A home equity loan, often known as a second mortgage, allows homeowners to borrow a lump sum of money based on the value of their home that they've already paid for. This loan type usually has a fixed interest rate and is repaid in regular installments over a specified period.

Defining Home Equity Line of Credit (HELOC)

A HELOC, on the other hand, functions more like a credit card. You'll be given a credit limit based on your home's equity, which you can draw from as needed. Unlike a home equity loan, a HELOC offers a variable interest rate. You will only pay interest on the amount you've drawn out.

Key Differences Between Home Equity Loan and HELOCs

Distribution of Funds

The first notable difference between a home equity loan and a HELOC is how the funds are distributed to you. With a home equity loan, you receive a lump sum of money all at once. Conversely, a HELOC allows you to draw money as you need it, up to a preset credit limit.

Interest Rates

While home equity loans generally come with fixed interest rates, a HELOC usually has variable interest rates. This means that with a home equity loan, your monthly payments will remain the same for the life of the loan. However, with a HELOC, your payments can fluctuate with changes in interest rates.

Repayment Terms

For a home equity loan, you start repaying the loan immediately with fixed installments. However, for a HELOC, there's typically a draw period during which you can access the funds, followed by a repayment period. During the draw period, which could last up to 10 years, you only have to make interest payments. Once you enter the repayment period, you will have to start paying back the principal as well as the interest.

Choosing Between a Home Equity Loan and a HELOC

Your choice between a home equity loan and a HELOC depends on your financial needs, personal preferences, and circumstances. If you need a lump sum of money for a specific purpose, like a major home renovation or to consolidate high-interest debt, a home equity loan may suit you best.

If you want flexibility and access to funds when you need them, a HELOC might be the better option. HELOCs are particularly useful for expenses that occur over time, like home repairs, tuition payments, or medical bills.

Both home equity loans and HELOCs can be powerful tools for homeowners looking to leverage the value of their homes. However, remember that in both cases, your home serves as collateral. That means if you default on the loan or line of credit, the lender could foreclose on your home. Make sure to carefully consider your ability to repay before borrowing against your home's equity.

Home equity loans and HELOCs offer two distinct ways for homeowners to access cash. They each come with their benefits and drawbacks, determined by their unique characteristics and terms. Understanding these differences will help you make an informed decision that aligns with your financial needs and goals.

To learn more about your financing options, contact a loan originator in your area today.