A temporary buydown is a mortgage loan option in which the seller or lender reduces the interest rate for the first 1-3 years of the homebuyer’s loan.

Who Can Benefit from a Temporary Buydown?

A temporary interest rate buydown can benefit all parties involved.

Benefits for Homebuyers

Homebuyers benefit as they’re able to ease into their mortgage a little more gradually. In addition to rising costs of goods, there may be extra costs associated with buying a house like a down payment, closing costs, mortgage insurance, etc. Everyone’s situation is different, but it’s always nice to be able to offset those extra expenses with a graduated payment.

Benefits for Sellers

Homebuyers aren’t the only ones who reap the benefits of a buydown, though. If you’re selling your house, you likely want to sell it as quickly as possible. Offering a temporary buydown can give homebuyers an extra incentive to purchase your property without you having to lower the list price.

How Does a Buydown Work?

Interest rate buydowns are typically offered in a 3-2-1, 2-1, or 1-0 format. The seller or lender covers the difference between what your payment typically would be and the adjusted, bought-down rate.

Seller-Paid Buydowns

If you are in the process of purchasing a home, you can ask your Realtor to negotiate a buydown with the seller (or builder, if you’re purchasing a new construction). This is the most common way a buydown is conducted.

Lender-Paid Buydowns

Waterstone Mortgage also offers a lender-paid 1-year buydown option,* where we will cover the cost to buy down your interest rate for the first year, at no additional cost to you. This can be particularly beneficial in a competitive real estate market where sellers may not offer an interest rate buydown option.

If you need some help getting started, contact a Waterstone Mortgage loan professional today — we can walk you through the process.

What Loan Programs Can I Use a Buydown With?

At Waterstone Mortgage, temporary interest rate buydowns are available with a variety of programs, including:

- Conventional loans — Low-down-payment home loans with a variety of qualifications to meet your needs

- FHA loans — Low down payment and credit score requirements

- USDA loans — No down payment required for homes in rural (and some suburban) areas

- VA loans — No down payment required for veterans, active-duty military members, and some surviving spouses

- Jumbo loans** — Mortgage loans for amounts above the conforming loan limit (only available with seller-paid buydowns)

…and more!

Plus, buydowns can be combined with select down payment assistance programs.

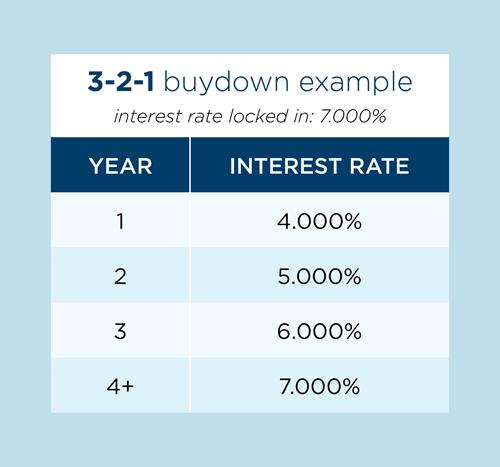

Temporary Buydown Example

If you’ve locked in a 7.000% interest rate, a 3-2-1 buydown would allow you to make monthly payments at a 4.000% interest rate for the entire first year of your mortgage. Then, in year two, your payments would be based on a 5.000% interest rate. In the third year, your payments would be based on a 6.000% interest rate. Finally, once you hit year four and for the remaining life of your loan, your payments would reflect your originally-agreed-upon 7.000% interest rate.

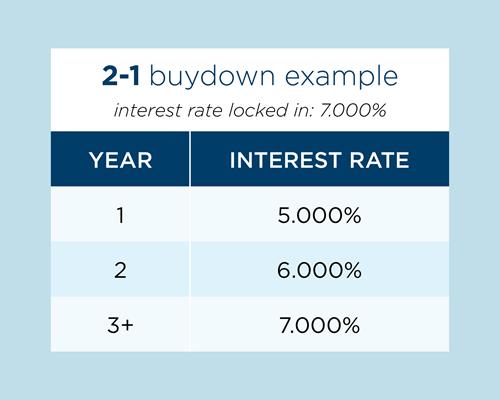

The same process would follow for a 2-1 buydown, except your interest rate would be reduced for years one and two, then resume your locked interest rate in year three.

For a 1-0 buydown, the interest rate is reduced by 1% for the first year before adjusting to the original rate.

Interested in purchasing a new home, but like the idea of easing into your mortgage payments? Contact a Waterstone Mortgage loan professional today to get started.

Realtors and builders, if you’re interested in facilitating a 3-2-1, 2-1, or 1-0 buydown for one or more of your clients, find a Waterstone Mortgage loan originator in your area.

The examples above are solely for displaying the difference in interest rate. The Annual Percentage Rate (APR) is not provided because the examples are for informational purposes to display the adjusted rates associated with a temporary buydown and do not reflect any finance charges that may be included in the APR.

*Lender-paid interest rate buydown financing option is only available for a primary residence, purchase transactions. Available with conventional, FHA, USDA, and VA loans — ask your mortgage professional for more details. **Jumbo loans only available with seller-paid interest rate buydown financing option — ask your mortgage professional for more details.

If the mortgage is paid in full or foreclosed during the lender-paid temporary buydown period, any remaining lender-paid temporary buydown funds will be applied to reduce the outstanding principal balance only. No lender-paid temporary buydown subsidy funds can be used to offset delinquent or past due payments or late fees. A lender-paid temporary buydown is for a first lien mortgage loan.